Every year around this time I sit down to craft a letter wishing you joy and happiness around the holidays and the shift to a new year. This year feels substantially different. This year feels like it requires something deeper, and perhaps even more personal, than mere wishes of good tidings. 2020 feels like it requires recognition.

Please know that I recognize that you’ve had to make personal, professional, or business sacrifices this year. I understand that this year may have included physical, mental and emotional stress. That it may not have been the year of joy and happiness that I wished for you at this time last year. Let me also recognize that you and your organization are still here. And that I recognize the efforts all have made to be so. If you did have to sacrifice, allow me to wish that the sacrifice pays off down the road.

2020 has been a year of change, of pivoting, of evolution. I recognize that all of those elements may at times be maddening. We have all conducted ourselves in a manner to best adapt to the changing landscape. I wish that the changes be recognized for newly created efficiencies and growth, for where they’ve spurred creativity within our lives and businesses, and for prosperity to blossom out of the necessity therefor.

Finally, I recognize the continued trust you place in us as your trusted advisors. I recognize the importance of your partnership in an increasingly volatile world. The value of your people, and the sanctity of the job we perform to help keep you and your team safe, as well as to help your employees strive for retirement with dignity. I appreciate the friendships our teams have built and continue to foster. And I recognize your desires, hopes for your career, your employer, and your family. Thus, on behalf of all of us, I renew my wishes from prior years for health, happiness, prosperity, and safety.

I wish you all warm holidays and a strong 2021.

Best,

Joel B. Shapiro

Post-Election Investment Commentary

Stock markets abhor uncertainty. Currently, investment prognosticators are interpreting the election results to create a relatively “stagnant” legislative environment. This opinion is based primarily on the Senate remaining in Republican control with the presidency Democratic. The anticipated stagnation connotes a more predictable investment environment. Clearly, the stock market has recently responded overwhelmingly positive (as of 11/10/20), to the reduced potential of increased taxation along with the greater likelihood of additional COVID-19 aid and economic stimulus.

This leaves some investors with an instinctual response to grow their equity exposure. However, the biggest risk investors face at this time is changing their investment course and getting it wrong. It remains important to keep focus on the long-term horizon, which no one can predict with much accuracy. The potential future variables that can impact markets are limitless. The impact of the pandemic and potential ensuing lockdowns is clearly one significant unknown.

What is a prudent investor to do? Assuming you are appropriately diversified, remaining so may be your best response.

Those initiating portfolio changes now based on campaign rhetoric should consider that the proposed policy changes may not materialize in current proposed form. If some do, it is difficult to assess which policies may be implemented and how they may affect the markets both US and internationally.

Long-term investing success is a function of innovation, economic growth, interest rates, productivity, and factors we may not currently foresee. Maintaining an appropriately diversified, low cost investment strategy which is properly funded, may not be exciting or pacifying today, but it most likely will provide financial success in the long term.

Cyber Security Issues for Plan Sponsors

The Department of Labor is working on a guidance package addressing cybersecurity issues as they relate to plan sponsors and third-party providers.

Tim Hauser, Deputy Assistant Secretary for DOL’s Employee Benefit Security Administration (EBSA) has indicated that we should expect more focus in the department’s investigations of the adequacy of various cybersecurity programs to confirm that service providers plan sponsors hire are practicing effective cybersecurity practices.

Mr. Hauser also indicated that the forthcoming guidance would be informal, and not a formal notice and comment.

Plan Sponsor Considerations

The DOL expects there to be questions asked when hiring a TPA or record-keeper.

- What practices and policies do the service provider have to ensure their systems are secure?

- Does the service provider have regular third-party audits by an independent entity?

- How does the third party validate their systems cybersecurity?

- Is there any history of cybersecurity incidents? If so, what is their track record?

- What did they learn from any prior incidents, and how have they improved their defensive processes?

- Do they indemnify their clients in event of security systems breaches that result in losses?

- Do they have insurance policies to make you whole and cover breaches, or do they have all sorts of waivers and exculpatory clauses in their contracts?

In the event a security breach is identified and an offender has achieved access to confidential information, the plan sponsor should produce a documented response, including notifying law enforcement, the FBI, the plan and their participants.

Once an official final guidance package is made available, we will share that information with you.

Annual Retirement Plan Notices

It is that time when plan sponsors need to send annual notices to participants. The 401(k) safe harbor, qualified default investment alternative (“QDIA”), and automatic enrollment notices must all be sent to plan participants between 30-90 days before the beginning of the plan year (i.e., no later than December 2nd for calendar year end plans), and may be combined into a single document.

401(k) Safe Harbor

Plan sponsors of safe harbor matching contribution plans can retain the flexibility to reduce future contributions by issuing “maybe not” language in their annual 401(k) safe harbor notice.

Prior to this year, safe harbor non-elective contribution plans had to be in place as of the first day of the plan year and were subject to the safe harbor notice requirements. Effective beginning January 1, 2020, not only can a 401(k) plan be converted into a safe harbor non-elective plan at any time during the plan year or even during the following plan year, but the notice requirement has been eliminated. Generally, safe harbor plans can make a mid-year reduction or suspension of a safe harbor contribution, but only if the employer is either (1) operating at an economic loss, or (2) had already provided a “maybe not notice”. As a result of the economic downturn created by COVID-19, the IRS issued temporary relief from this limitation on suspensions.

QDIA

If your plan contains a QDIA, you must provide an annual notice to all participants who were defaulted or may be defaulted into the QDIA in order to retain this fiduciary protection. Many plan sponsors send the notice to all plan participants.

Automatic Enrollment

If your plan contains an automatic enrollment feature, you must send an annual notice describing the automatic enrollment to all participants who have been or will be automatically enrolled and haven’t made an affirmative election to change their deferral percentage.

Participant Corner: The 10% Savings Goal

This month’s employee memo encourages employees to conduct a regular examination of their retirement plan to determine whether any changes need to be made. Download the memo from your Fiduciary Briefcase at fiduciarybriefcase.com. Please see an excerpt below.

Most people need to save more — often a lot more — to build a nest egg that can meet their needs. Many financial experts recommend putting away 10 to 15 percent of your pay for retirement. There’s a relatively painless way to reach that goal.

Take small steps

- Begin by contributing enough to receive your employer’s matching contribution

- Consider gradually raising your contribution amount to 10 percent or higher

- Raise your plan contributions once a year by an amount that’s easy to handle, on a date that’s easy to remember—say, 2 percent on your birthday. Thanks to the power of compounding (the earnings on your earnings), even small, regular increases in your plan contributions can make a big difference over time.

A little more can mean a lot

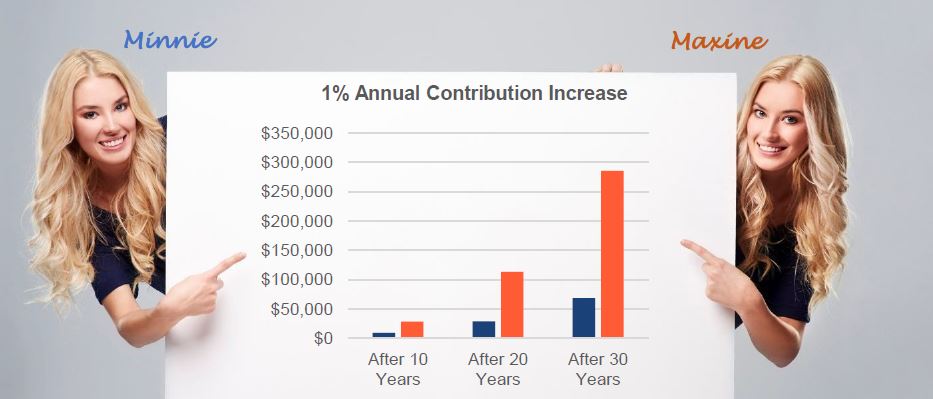

Let’s look at Minnie and Maxine. These hypothetical twin sisters do almost everything together. Both work for the same company, earn the same salary ($30,000 a year), and start participating in the same retirement plan at age 35. In fact, just about the only difference is their savings approach:

Minnie contributes 2 percent of her pay each year. Her salary rises 3 percent a year (and her contributions along with it), and her investments earn 6 percent a year on average. So, after 30 years of diligent saving, Minnie will reach retirement with a nest egg worth $68,461.

Maxine gets the same pay raises, saves just as diligently, and has the same investments as her sister—except for one thing: She starts contributing 2 percent, but raises her rate by 1 percent each year on her birthday until she reaches 10 percent. She will keep saving that 10 percent for the next 22 years, until she retires by Minnie’s side.

Maxine tells Minnie that she’s never really noticed a difference in take-home pay as her savings rate rises. Instead, she looks forward to having $285,725 in her retirement fund by age 65.

Think ahead and act now. To increase your deferral percentage, contact your HR department today.

This memo was contributed by Transamerica.

This example is hypothetical and does not represent the performance of any fund. Regular investing does not guarantee a profit or protect against a loss in a declining market. Past performance does not guarantee future results. Initial tax savings on contributions and earnings are deferred until distribution. You should evaluate your ability to continue saving in the event of a prolonged market decline, unexpected expenses, or an unforeseeable emergency.

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation.

This newsletter is distributed for general informational purposes only. No part of this newsletter nor the links contained therein is a solicitation or offer to sell investment advisory services. Information throughout this newsletter is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness, accuracy or completeness of this information and the information presented should not be relied upon as such. All investments involve risk of loss, including the possible loss of all amounts invested, and nothing within this newsletter should be construed as a guarantee of any specific outcome or profit. This newsletter is confidential and is intended solely for the information of the person to whom it was delivered and may not be reproduced or redistributed in whole or in part, nor may its contents be disclosed to any other person under any circumstances.