Are Your Participants Experiencing a Fee Imbalance?

Subsequent to the 2012 implementation of ERISA fee reporting regulations (ERISA 408(b)(2) & 404(a)(5)), the Department of Labor (DOL) began to consider the appropriateness of the allocation of plan fees among participants. This is a subject that generally had not been on the radar screen of many plan fiduciaries, but once identified, tends to generate considerable traction due to its obvious validity. Ironically, a plan sponsors’ diligent attention to obtaining the lowest accessible share class for new funds in plan menus has contributed to this fee imbalance among a plan’s participants.

Fred Reish, a partner with Drinker Biddle in the Los Angeles office has weighed in on this issue by stating, “While there are no requirements to charge equitable fees, in Field Assistance Bulletin (FAB) 2003-03, the Department of Labor (DOL) indicated that allocating plan expenses is a fiduciary decision that requires fiduciaries to act prudently… Whatever allocation method is used, failure by fiduciaries to engage in a prudent process to consider an equitable method of allocation of plan costs and revenue sharing would be imprudent and a breach of fiduciary duty.”

While ERISA does not prohibit the passing on of reasonable plan fees to participants, others concur with Reish that having a process to consider how fees are charged to each participant is a best practice sponsors need to consider.

Most plans contain funds in their menu that include fee ingredients, such as various revenue-sharing payments, that can contribute to participant fee imbalance. While there are some investments that do not offer a share class that has zero revenue sharing, many do. The simplest way to solve for the fee imbalance is by eliminating this fee ingredient altogether, wherever possible. But, this typically generates a revenue loss to your plan’s recordkeeper that needs to be recovered in some form. This revenue loss can be offset with an alternative, and more levelized form of revenue recovery, such as a fixed dollar quarterly participant fee (which is the ultimate in simplistic fee transparency), or an asset wrap fee (fees can increase as assets grow) or some combination of both. Combining both the quarterly fixed fee and asset wrap fee becomes of interest to plan fiduciaries when they realize that the fixed fee approach advantages the high account balance participant and the asset wrap approach advantages the low account balance participant. Some plans having an ERISA budget account established can remit revenue- sharing fees back to this account. Another method is for the provider to issue fee credits to participant accounts to achieve fee levelization.

Many plans have not yet addressed participant fee levelization. Some reasons for this are lack of awareness on the part of plan fiduciaries, recordkeeper system limitations, and imperfect current solutions. Most industry people believe that participant fee levelization will eventually become ubiquitous as recordkeeper systems are adapted. Fee levelization is a difficult concept to refute as it logically makes sense and ignoring this issue may potentially lead to fiduciary liability concerns.

Most providers have been working on options that can remediate fee levelization concerns to some extent, if not fully. At this time, a prudent approach for plan fiduciaries is to investigate the appropriateness of current fee allocation structure among plan participants, consider opportunities to approach fee levelization with your current providers, and document the consideration process and conclusions.

Why You Need to Communicate with Employees

Businesses understand how vital it is for employees to understand retirement options and are increasingly including employee education in fiduciary risk management, whether it’s in the form of one-on-one counseling or educational seminars. Take a look at these reasons why you should communicate with and educate your employees.

Gossip Can Be Dangerous

If retirement opportunities are not properly explained, employees will likely ask each other instead. Someone could accidentally relay incorrect information and create the misconception that your savings plan options aren’t effective, leading to disgruntled, unsatisfied employees. This tends to snowball into frustration and a lack of trust. Make sure your employees know that you have their best interest at heart.

Open Communication

Create a culture of open communication. Encourage employees to approach you with questions, suggestions on benefits they’d like to see, or concerns, whether they’re positive or negative. Intentionally respect, honor, and reward that honest communication. This helps employees feel valued and happy, and a happy employee is a productive one.

Competitors Communicate

If you don’t provide the educational support your employees need, chances are good that there are competitors who will. If you struggle to find and retain great workers, this could be a contributing factor. Employees may believe your plan is inadequate when compared to what other businesses offer, so by conveying your plan’s many benefits, you can avoid this problem and keep employees happy.

Employee Success Is Business Success

Employees are interested in working for thriving companies that offer exceptional benefits. Since high employee morale has been connected[1] to great customer service, know that if you take care of your employees, they will in turn take care of your clients. Satisfied customers will recommend you to friends and your business will continue to grow.

Communication is an important part of fiduciary risk management[2]. By making an effort to counsel and educate your employees on 401(k) programs, HSAs, and other retirement options, you’ll improve morale and quickly grow your business.

[1] https://siclytics.com/employee-morale-and-customer-satisfaction-go-hand-in-hand/

[2] http://fiduciaryfirst.com/fiduciary-risk-management

What Constitutes Proper Documentation of Retirement Plan Committee Meetings?

With most retirement plans, the fiduciary responsibility of selecting and monitoring the plan’s menu of investments is designated to a retirement plan investment committee. This committee usually includes financial officers and human resources officers of the employer. The committee meets periodically (anywhere from annually to quarterly) to consider agenda items including investment due diligence, fees and services of plan providers, status of plan goals, etc.

From a fiduciary perspective it is just as important to properly document these meetings as it is to hold the meetings. Proper documentation serves as proof that the committee’s responsibilities are being prudently executed. Often plans question the degree of documentation necessary. Below are a few suggestions of what the retirement plan investment committee meeting minutes should include:

- A listing of all parties present with identification of roles (committee member, guest, financial professional, provider representative, attorney, accountant, etc.);

- A description of all issues considered at the meeting: fund performance of investments offered, participant communication/education initiatives, plan demographic and provisional review, investment policy statement review, market summary and other topics as appropriate to achieving and maintaining a successful plan;

- Documentation of all materials reviewed during the meeting;

- Documentation of all decisions made and the analysis and logic supporting each decision; and

- Identification of any topics to be continued in subsequent meetings.

For those topics which are relevant to services provided by us, complete documentation will be included in the Executive Summary which your financial professional provides after each meeting. These documents should also be posted for you to access at any time during the year.

For more information, contact your plan’s financial professional.

Participant Corner: Good Health is the Best Wealth

This month’s employee memo encourages employees to make small lifestyle changes to reduce their out-of-pocket health costs. The memo shows the difference in savings between an average-managed patient and a well-managed patient. Download the memo from your Fiduciary Briefcase at fiduciarybriefcase.com. Please see an excerpt below.

Believe it or not, staying healthy just might make you wealthy. With small lifestyle changes and healthy choices, you may reduce your annual healthcare costs and increase your income. These lifestyle changes can be as simple as limiting your salt intake or taking your prescribed medication regularly.

For example:

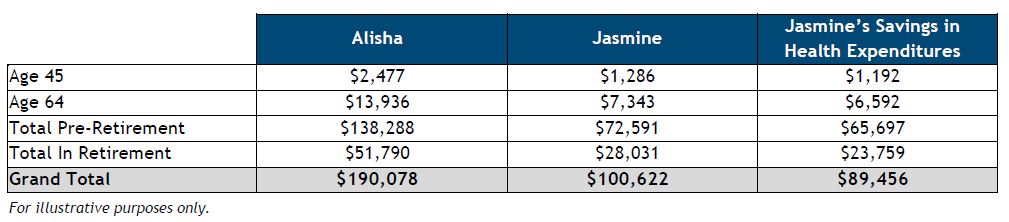

Alisha and Jasmine are both 45 years old and both sought medical treatment for high blood pressure. Alisha doesn’t follow the lifestyle changes her doctor suggested, whereas Jasmine diligently follows her doctor’s recommendations. With Jasmine’s small changes she saves more than $1,000 in out-of-pocket healthcare costs. Additionally, Jasmine’s combined pre-retirement and in-retirement savings will be $89,456 more than Alisha, as shown in the table below.

Annual Out-of-Pocket Healthcare Costs:

For more tips on preparing for healthcare costs, contact Marietta Wealth at (404) 549-6930, or visit us at www.mariettawealth.com.

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation.

The material presented was created by an outside vendor (or third party).

This newsletter is distributed for general informational purposes only. No part of this newsletter nor the links contained therein is a solicitation or offer to sell investment advisory services. Information throughout this newsletter is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness, accuracy or completeness of this information and the information presented should not be relied upon as such. All investments involve risk of loss, including the possible loss of all amounts invested, and nothing within this newsletter should be construed as a guarantee of any specific outcome or profit. This newsletter is confidential and is intended solely for the information of the person to whom it was delivered and may not be reproduced or redistributed in whole or in part, nor may its contents be disclosed to any other person under any circumstances.