The Case for Investment Refresh

Investment refresh is an optional extension to automatic enrollment whereby participants would be notified that, as of a certain date, their current investment allocation will be transferred to the plan’s qualified default investment alternative (“QDIA”) investment. The QDIA is frequently an age/risk appropriate target date fund (“TDF”). Any participant may opt out of this action prior to or at any time after the transfer date.

The premise underlying investment refresh is that participants do not always make prudent investment decisions. We frequently find that, although the vast majority of participants are deferring into the plan’s TDF, their prior assets often do not get transferred. This is an interesting but contradictory fact that can be attributed to a conscious act, simple neglect, or potential loss aversion, but the reality is, that it may be detrimental to the participant’s actual intent or their best interest. In addition, we also know that there is often a mismatch between the level of risk participants tell us they are comfortable with and the risk level in the actual portfolio they have constructed.

Clearly, many participants would benefit from additional assistance. Our experience tells us that investment refresh could provide significant help.

Excessive Fee Litigation: The Best Defense is Compliance

Excessive fee litigation is increasing at a steady pace and all signs are it will continue to increase. The positive side of this situation is that we now have more caselaw to consider as we work toward compliance in creating a “best defense”. Early caselaw did not reflect the consistency of court decisions. Some court rulings were in direct conflict with those of other courts, and some did not seem well reasoned.

Recent excessive fee caselaw does help us determine a more solid foundation for liability mitigation. Clearly, it is most important to have a robust process for making prudent investment decisions, as per ERISA “procedural prudence”. This has always been the case, but now we have more clarity in how this process should be conducted. Courts want to see evidence that based on the information that the fiduciaries had at the time they made their decision; a robust structured process was followed. As always, it is crucial that you follow your investment policy statement and document your process and reasons for all fiduciary level decisions.

QDIA…. Why is it important?

The qualified default investment alternative (“QDIA”) is arguably the most important investment in a plan’s investment menu. By far the most often selected QDIA investment is a target date fund (“TDF”). TDFs are typically the only investment selection that offers unitized professionally managed portfolios that reflect the participants’ time horizon today and as they go to and through retirement.

TDFs are tied to the anticipated year of your retirement. Retiring in 2035? The 2035 TDF is the easy pick. This portfolio will be professionally managed to become more conservative as you approach your retirement. This de-risking is based on an investment “glide path” which contains more aggressive investments during the participant’s younger years and utilizes more conservative investments as retirement approaches.

TDF QDIA selection is important for plan fiduciaries as well. The Department of Labor (“DOL”) has indicated that if the TDF has been prudently selected and commensurate with the plan’s participant demographics, the suite meets certain structure requirements, and required notices are provided, fiduciary liability mitigation would be available. Prudent process entails identifying your participant demographic needs. Your participant demographic need may tend towards a low-risk portfolio (e.g. participants are on track for a satisfactory retirement), or perhaps a more aggressively positioned portfolio (e.g. less savings so the need to obtain higher returns), or perhaps a multiple glidepath approach for a financially non-homogenous population.

Prudence of TDF selection is also determined by cost relative to other TDFs with similar risk levels, as well as the quality of underlying investments.

Participant Corner: Tax Saver’s Credit Reminder

This month’s employee memo informs employees about a valuable incentive which could reduce their federal income tax liability. Download the memo from your Fiduciary Briefcase at fiduciarybriefcase.com.

You may be eligible for a valuable incentive, which could reduce your federal income tax liability, for contributing to your company’s 401(k) or 403(b) plan. If you qualify, you may receive a Tax Saver’s Credit of up to $1,000 ($2,000 for married couples filing jointly) if you made eligible contributions to an employer sponsored retirement savings plan. The deduction is claimed in the form of a non-refundable tax credit, ranging from 10% to 50% of your annual contribution.

Remember, when you contribute a portion of each paycheck into the plan on a pre-tax basis, you are reducing the amount of your income subject to federal taxation. And, those assets grow tax-deferred until you receive a distribution. If you qualify for the Tax Saver’s Credit, you may even further reduce your taxes.

Your eligibility depends on your adjusted gross income (AGI), your tax filing status, and your retirement contributions. To qualify for the credit, you must be age 18 or older and cannot be a full-time student or claimed as a dependent on someone else’s tax return.

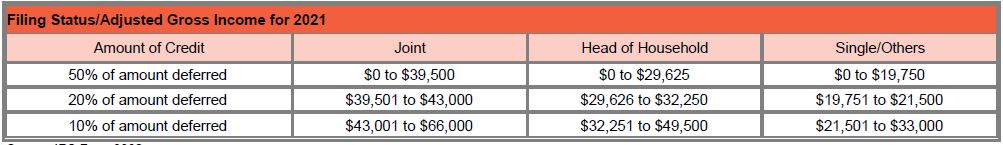

Use this chart to calculate your credit for the tax year 2021. First, determine your AGI – your total income minus all qualified deductions. Then refer to the chart below to see how much you can claim as a tax credit if you qualify.

For example:

- A single employee whose AGI is $17,000 defers $2,000 to their retirement plan will qualify for a tax credit equal to 50% of their total contribution. That’s a tax savings of $1,000.

- A married couple, filing jointly, with a combined AGI of $42,000 each contributes $1,000 to their respective retirement plans, for a total contribution of $2,000. They will receive a 20% credit that reduces their tax bill by $400.

With the Tax Saver’s Credit, you may owe less in federal taxes the next time you file by contributing to your retirement plan today!

Distributions before the age of 59 ½ may be subject to an additional 10% early withdrawal penalty. This is for informational purposes only; we suggest that you speak with a tax professional about your individual situation.

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation.

This newsletter is distributed for general informational purposes only. No part of this newsletter nor the links contained therein is a solicitation or offer to sell investment advisory services. Information throughout this newsletter is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness, accuracy or completeness of this information and the information presented should not be relied upon as such. All investments involve risk of loss, including the possible loss of all amounts invested, and nothing within this newsletter should be construed as a guarantee of any specific outcome or profit. This newsletter is confidential and is intended solely for the information of the person to whom it was delivered and may not be reproduced or redistributed in whole or in part, nor may its contents be disclosed to any other person under any circumstances.