Index Funds – Looking Beyond Fees

Ryan Hamilton, Investment Analyst

The flow to passive management is one of the biggest talking points of the decade. With this shift came the daunting task, and responsibility, to better evaluate the abundance of index funds offered by the marketplace. Index funds seek to replicate the performance of a benchmark, making the idea of comparing returns appear counterintuitive.

This notion has led many to focus almost entirely on fees. During this time period the industry experienced significant fee compression, with the difference between a few of the most commonly utilized index funds as small as 0.002%. This amounts to $2 for every $100,000 invested. Relative to the administrative burden to switch funds, investment cost is not the best method of selecting funds especially considering that shortly after, a different fund may be the new lowest-cost option.

How else can an index fund differentiate itself from its competitors – If not fees, what should be evaluated? The best index fund managers provide tight benchmark tracking at a reasonable price, and two techniques they can incorporate into their investment process are cross trading and securities lending.

Through the application of certain trading techniques, index managers can reduce cost and improve tracking. Over time the composition of indexes change, yet the process funds undergo to match these changes are complex. For example, as companies grow, they may move from the small cap index into the large cap index. For the index, this is a simple process. One day the company is in the small cap index and the next day they are in the large cap index. No trading needs to occur, no commissions paid, no bid-ask spreads crossed, no trades routed – yet funds must overcome these hurdles if they want to match the index’s performance.

One technique to overcome these challenges is through the use of cross trading. Suppose a fund company offers a small cap index fund and a large cap index fund and “company X” is being moved from the small cap index to the large cap index. The fund company could sell all their shares of “company X” in the small cap fund. This incurs cost and drives the price down as they sell. Then they buy all the shares back in their large cap fund, driving the price up as they buy. Through cross trading, this process is more streamlined. The fund company transfers their shares of “company X” from their small cap fund to their large cap fund without incurring costs. This leads to reduced tracking error and improved performance. To conduct due diligence on an index manager’s cross trading capabilities examine the index fund company’s cross trading process and review percentages of trades crossed.

The second method by which an index fund can be evaluated is through their use of securities lending. Securities lending refers to the temporary lending of a stock, derivative, or bond by one party to another in exchange for collateral. The collateral can be reinvested to produce income for the lender. Securities lending is important to short sellers who profit when securities drop in value. If an active investor is looking to short “stock ABC”, currently worth $100, they can borrow “stock ABC” from an index fund, offering the fund $103 as collateral. The index fund can invest this cash until the stock is returned, generating extra return, helping offset the costs the fund faces.

It is important to remember this is not risk-free money for the fund. This process exposes the fund to counterparty risk – which is when the active investor does not return the stock owed. The second is reinvestment risk – when the fund invests the $103 and it loses value. To mitigate this risk many fund companies have adopted SEC or OCC money market guidelines that outline the maturity, credit ratings, and liquidity restrictions on the collateral investment. Well established index providers will furnish information on their counterparty and collateral guidelines.

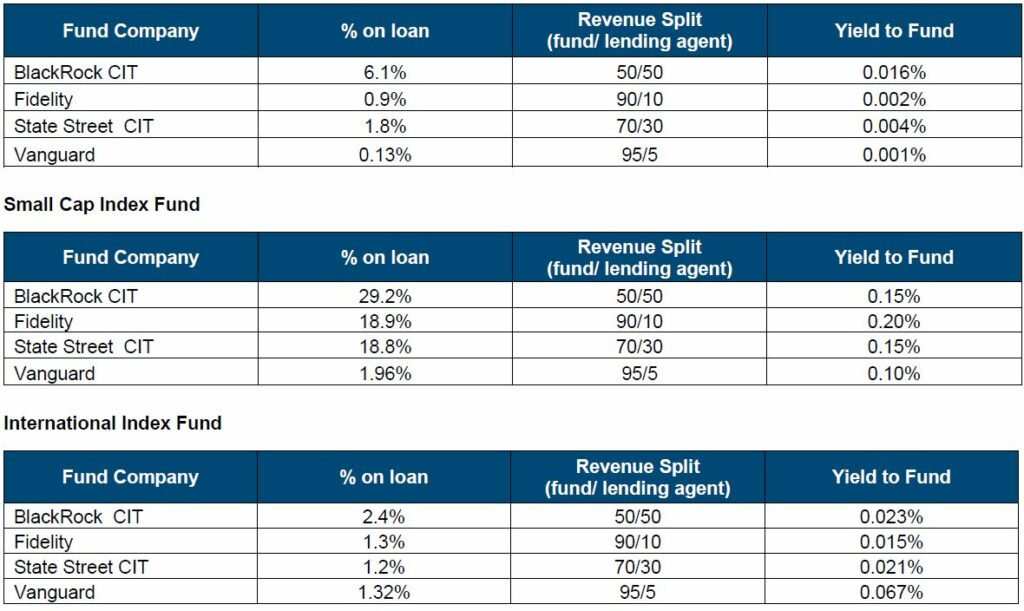

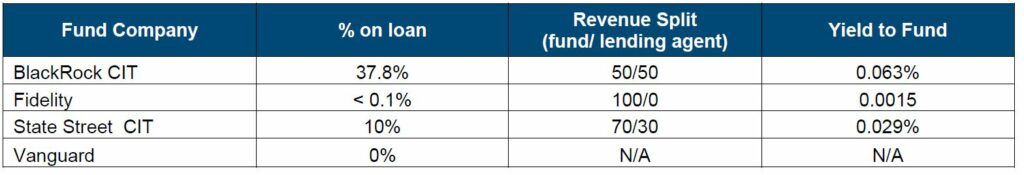

How much extra return can securities lending generate? Looking at the graphs below we can see significant additional return through securities lending, sometimes in excess of the management fee charged by the fund.

500 Index Fund

2018 Securities lending information

These complex features, prevalent amongst passive managers explain why RPAG tailored the scorecard to evaluate passive managers on analytics and metrics specific to, and important for, passive funds. On the surface it might seem counter intuitive to include an analytic on return rank for a passive fund designed to match the performance of a benchmark. However, by including return rank we evaluate a fund’s effectiveness in securities lending and cost reduction through cross trading.

Two analytics dedicated to tracking error may seem unnecessary, however performance matching is a primary objective of passive funds. It is critical for managers to utilize every tool in their toolbox. An emphasis on tracking error allows for better assessment of how well managers are meeting this objective. While fees are an important component of evaluating a passive manager, it is not the only data point, and the RPAG scorecard incorporates all significant components into the analysis.

For more information about cross trading and securities lending, reach out to your plan advisor.

Student Loan Contribution Programs: The New Way to Recruit and Retain Millennials in Today’s Workplace

As human resource managers begin working on updating their benefits package, it’s important to remember that millennials are quitting their jobs faster than employers can hire them1 – which is especially problematic considering millennials now make up 50 percent of the workforce 2.

The reasons for resignations vary widely, but one retention solution may be to consider offering a student loan contribution program. In 1999, the amount of outstanding student loan debt was approximately $90 billion. In 2019, that amount that has grown to nearly $1.6 trillion – held mainly by millennials. It’s fair to say that this population is desperately looking for some relief from this heavy debt burden – which offers a unique opportunity for employers to recruit and retain millennial talent.

A recent survey by Laurel Road found that millennials who were offered a student loan contribution program in their benefits package stayed at companies five years longer than those who were not. Some surveys even concluded that a student loan contribution program can be more desirable than vacation days3.

A byproduct of the student debt problem is that millennials may not be saving enough for retirement. A recent study from Boston College’s Center for Retirement Research, found that college graduates with student debt, accumulate 50 percent less retirement wealth in their retirement plan by age 30 than those without4.

Many employees believe they must choose between paying off their loans and saving for retirement; however, a student loan repayment program allows employees to make considerable contributions to both their debt and retirement savings accounts.

Student loan contribution programs are offered at little to no cost by different providers, are fully tailored to most benefit programs and most importantly, may offer a solution to the student loan debt crisis. A majority of these innovative plans are set up in three unique ways:

- Refinancing Resources, which offer financial wellness tools as well as access to third-party loan refinancing.

- Loan Contribution Programs offer employer monthly contributions to employee student loans in addition to refinancing resources.

- Match Contributions, where employers make a retirement plan match when employees make a tuition loan payment. Again, refinancing resources are included.

These programs vary in shape and size, allowing companies to integrate this benefit with little interruption to company operations. The more competitive programs will offer refinancing, allowing workers to make smaller payments at less of an interest rate, with little to no cost to the employer. At its core, this program increases employee retention by reducing the financial strain brought on by student loans.

Consider implementing a student loan contribution program into your benefits strategy. You may find that your ability to recruit and retain millennial talent increases immensely!

- https://www.inc.com/robbie-abed/more-people-are-quitting-their-jobs-than-ever-before-heres-why.html

- https://www.inc.com/peter-economy/the-millennial-workplace-of-future-is-almost-here-these-3-things-are-about-to-change-big-time.html

- https://www.integrity-data.com/3-reasons-a-student-loan-repayment-benefit-is-a-good-choice-for-employers/

- https://crr.bc.edu/briefs/do-young-adults-with-student-debt-save-less-for-retirement/

Why We Use Russell Instead of S&P

Ever wondered why we use Russell instead of S&P for benchmarks in the RPAG system? Here are four important reasons:

- Russell ranks each company in the investable universe according to its total market capitalization while S&P uses a committee to make these decisions. Market cap is the primary indicator to determine where a company belongs in the Russell Index.

- Using a float adjustment methodology, Russell creates benchmarks that most accurately reflect the market, and Russell’s indices adjust each company’s capitalization ranking to eliminate closely held shares that aren’t likely to be traded.

- By updating index holdings on a regular basis and reconstituting them annually, Russell provides a truer representation of the market.

- Russell indices objectively allow the market to determine the index composition according to clear and published rules. The market determines which companies are included, not the subjective vote of a selection committee.

For more information the importance of a benchmark, contact your plan advisor.

Participant Corner: Borrowing Against Your Retirement Plan: More Costly Than You Think

This month’s employee memo informs participants about taking money out of their retirement plan. Download the memo from your Fiduciary Briefcase at fiduciarybriefcase.com and distribute to your participants. Please see an excerpt below.

PARTICIPATING IN THE COMPANY’S RETIREMENT PLAN is a smart and important decision. Smart because you are putting away small amounts today for a comfortable retirement later.

As your account begins to grow, it may be tempting to “dip into” your retirement savings by taking a loan against your retirement plan to pay your annual taxes, repair a leaking roof, catch up your everyday pile of bills, and so on. And while the decision to take a plan loan is yours to make, we want to make sure that you consider what it will really cost.

With a retirement plan loan, you pay yourself back the amount plus interest. But the true cost can be shown with the loss in your retirement savings. You lose money when you borrow from your retirement account for several reasons:

- You lose making money on the earnings, or compounding of those earnings.

- You repay the loan with after-tax dollars.

- There is (typically) an initial set-up and quarterly loan fee.

- Most employees decrease or cease the amount they are contributing to compensate for the loan payment.

- You may not be paying yourself back the same amount you would have earned if you left the money invested.

To further illustrate the costliness of taking a plan loan, consider the following hypothetical example*: Jane took a $10,000 loan at 7% interest from her retirement account; her account balance before the loan was $20,000. She previously made contributions of $150 per paycheck (including the employer match). Because she had to repay the loan, she decreased her contribution to $50. Additionally, prior to the loan, she was earning a 10% return. Now she will repay the loan over five years. If you take into account loss of interest, compounding, and tax on repayments, the actual retirement plan loan is costing Jane 13.77%! And don’t forget about those decreased contributions, which can add up to hundreds of thousands of dollars over many years.

*This example is hypothetical and intended for illustrative purposes only.

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation.

This newsletter is distributed for general informational purposes only. No part of this newsletter nor the links contained therein is a solicitation or offer to sell investment advisory services. Information throughout this newsletter is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness, accuracy or completeness of this information and the information presented should not be relied upon as such. All investments involve risk of loss, including the possible loss of all amounts invested, and nothing within this newsletter should be construed as a guarantee of any specific outcome or profit. This newsletter is confidential and is intended solely for the information of the person to whom it was delivered and may not be reproduced or redistributed in whole or in part, nor may its contents be disclosed to any other person under any circumstances.